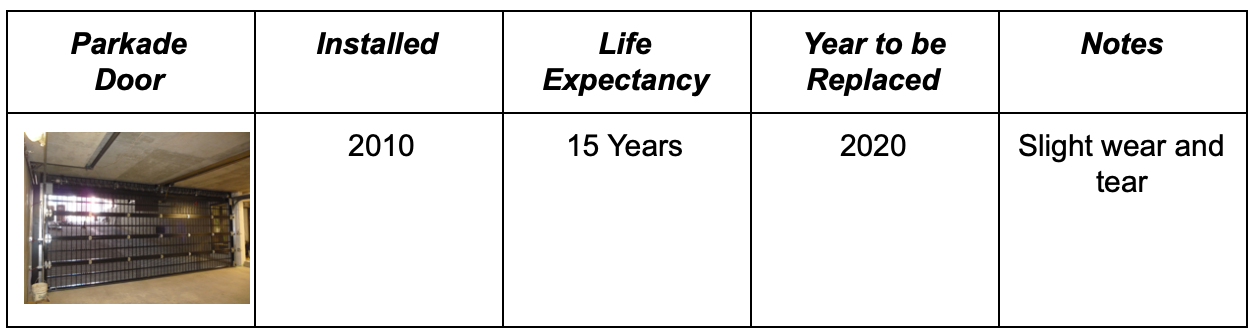

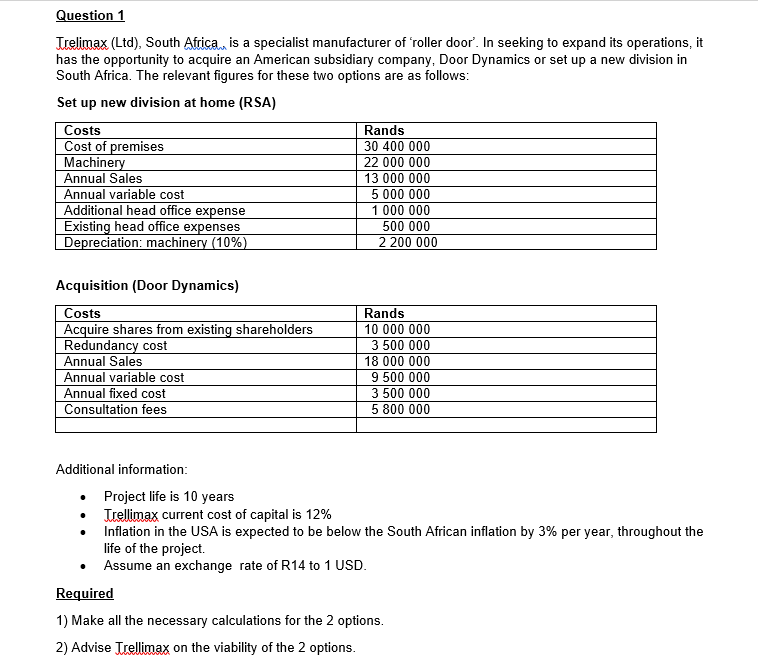

Garage Door Depreciation Life

The garage door is an integral component of the rental dwelling structure and as such its replacement cost would be depreciated over 27 5 years.

Garage door depreciation life. Rotate log in or sign up to reply. Repair expense or capital improvement. Depreciation for residential rental property assets. Are generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

An item that is still in use and functional for its intended purpose should not be depreciated beyond 90. However under new de minimis rules you are able to deduct the entire cost in the year of purchase. I am of the opinion that is a new capital asset and is normally depreciated over 27 5 years. View solution in original post 0.

The checklist represents the ato s current views on which assets can be depreciated under division 40 and which assets may be eligible for the building write off under division 43. Provides direction to effectively utilize resources in the classification and examination of a taxpayer who is recovering costs through depreciation of tangible property used in the operation of a restaurant business. It also provides the effective life of those assets which may be depreciated. You then deduct the depreciation from income every year of the useful life.

Rental property garage door replacement. The irs places assets and capital improvements into classes of useful lives. If you choose to depreciate the garage door opener select appliances carpet furniture category and the software will use the 5 year class life. To determine yearly depreciation divide the cost of the asset by its useful life.

Repainting the exterior of your residential rental property.